The People’s Bank of China (PBoC) ordered its banks to power a V-shaped recovery through an explosion of credit—a record CNY 10 trillion ($1.5 trillion) in new loans, or double the 2008 total. Roughly a quarter of the new loans were channelled into the Shanghai red-chip stocks and property markets, designed to inflate their values.

The combined fiscal and monetary stimulus—equal to 45% of China’s GDP—spurred the juggernaut economy to an estimated 10% growth rate in the fourth quarter, up from 6% growth in the first quarter.

China’s economic growth is set to return to double digits in 2010, with booming factory activity driving its Purchasing Managers’ Index (PMI) to a reading of 56.6 in December from 55.2 in the previous month. South Korea, Asia’s fourth-largest economy, said its exports to China were 75% higher at $54.2 billion during the month of December (comparable statistics from China are awaited).

However, China’s accelerating economy is also increasing worries among some of the People’s Bank economists that the consumer price deflation experienced through most of 2009 will quickly flip to rapidly escalating inflation in 2010.

China’s voracious appetite for agricultural commodities, crude oil, base metals, and other industrial raw materials is transmitting inflationary pressures worldwide, with the epicentre located in China itself and in neighbouring India.

The PBoC finds itself far behind the ‘inflation curve’, and hasn’t yet gone beyond meaningless ‘open mouth’ operations in order to tame budding pressures lurking beneath the surface. The Dow Jones Commodity Index made a stunning U-turn last year, rebounding sharply from an annualised rate of decline of 52% in July to an annual inflation rate of 23% in December, 2009.

With key commodity prices expected to extend their advance in 2010, an outburst of escalating inflation lies on the horizon for the Chinese economy.

This could invite policy actions from the PBoC from time to time, similar to the ones witnessed recently on January 8 and 12. As and when these happen, the rally in commodity prices could get temporarily derailed.

Yet, considering the glut of liquidity all over the world, the outlook for commodity prices in 2010 is positive.

Steel

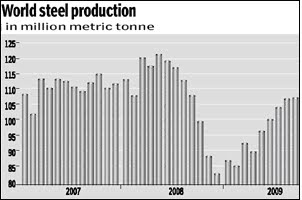

The LME steel contract was introduced in April last year. After falling off a cliff in fall 2008, prices rose more or less consistently over 2009. The price of steel stalled in October 2009 despite the fact that stocks had come down after...

peaking at the start of the year.

Indeed, a considerable slowdown in the de-stocking process is currently taking place. Since the end of 2008, inventories have been run down as production and imports for consumption alike have fallen rapidly.

Recently, world production has started to bounce back, albeit from historical lows. In light of our relatively optimistic global growth forecast (given very loose monetary policies which I believe will stay in force across the world for most of 2010), I would expect steel demand to recover soon. ISM and US steel production have co-moved closely in the past, and I forecast that ISM will reach 60 mark in early 2010—this bodes well for steel demand and could thus put upward pressure on prices.

The futures curve remains in contango but no open interest exists for contracts further out than January 2010. Slope and curvature are broadly unchanged since last year but the curve has seen a downward level shift over the past month. Overall, we see steel prices rising alongside other base metals during 2010.

With nickel and zinc being important inputs to steel production, a virtuous circle of rising prices for this set of metals cannot be ruled out.

On a wider global scale, however, one needs to remain more cautious as demand has not yet shown clear signs of recovery, and in the near term price movements will most likely depend on the amount of furnace restarts.

Copper

Construction activity in the US has started to show signs of recovery: new home sales have witnessed a turnaround and building permits have risen, albeit from historically low levels. Together with the rebound in Chinese imports, such figures may have been supportive for copper prices lately.

Copper production has risen somewhat, but in contrast with aluminium where overcapacity could become a crucial factor, falling ore grades at a range of mines implies that copper supply could surprise on the downside going forward. If global demand simultaneously picks up noticeably, this could exert some upward pressure on copper prices.

The copper market performed notably better than aluminium in 2009, boosted by relatively low inventories. Copper stocks saw a considerable draw over the summer as Chinese stockpiling gained pace. However, imports fell back somewhat in August before bouncing back in September, 2009, and China remains a net importer of the metal by a large margin.

However, one can still see copper stocks being at elevated levels, which surely does not justify the sharp rise we have seen in copper prices of late.

Chinese macroeconomic news has generally surprised on the upside recently: real GDP growth came in at 8.9% YoY in Q3, and retail sales and industrial production alike have continued to rise after bottoming out at the start of 2009.

Although the OECD Composite Leading Indicator for China remains below the 100 boom/bust level, recent data hints that the Chinese economy is gaining momentum. This, in turn, bodes well for demand for copper—and metals in general—going forward. CFTC data on non-commercial positioning in copper has turned net long lately, suggesting that bets on rising prices are now outnumbering the bets against. Again, I must reiterate that all this is happening against the backdrop of rising copper inventories, which makes things difficult to reconcile.

Source: Financial Express

__________________________________________________________________________________

No comments:

Post a Comment