High international crude prices will not affect the domestic price of natural gas in the future, as per a government plan to revise the price structure for the sector. The petroleum ministry is planning a new pricing formula that will delink prices of crude from the production-sharing contracts that gas producers sign with the government. In other words, they cannot arrive at the price of the gas from their wells based on how global crude price behaves.

The new formula will produce a more realistic pricing of natural gas in the light of its own unique demand-supply mechanics, which contrasts sharply with the highly volatile global crude oil price, said a government official, who asked not to be named. The move will impact both public and private sector companies, including ONGC, Reliance Industries and BG. The formula will produce a more realistic pricing of natural gas in the light of its own unique demand-supply mechanics, which contrasts sharply with the highly volatile global crude oil price, said a government official, who asked not to be named.

“Although natural gas and crude oil are produced from the same field, both have different costs of production and different demand-supply maths. The profitability of a gas producer depends on cost dynamics and not crude oil price. This warrants decoupling of gas price from crude oil price,” said the official.

This could have implications on the profit margins of the largest gas producer RIL as well as future producers. In the new plan, the government could be conservative in its assessment of costs which, therefore, could impact the margins to be allowed once gas price is delinked from oil price.

The new pricing regime has got a fillip after the Supreme Court, in its verdict on the RIL-RNRL case, introduced a clear govenment role in the pricing of natural gas as a national resource.

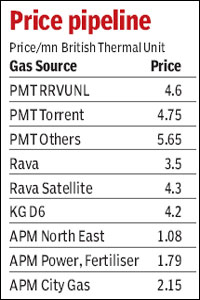

Now, gas from RIL’s KG D6 lease — accounting for 43% of the country’s total output — is priced for five years from the start of production at $4.2 per unit for crude oil price greater or equal to $60 a barrel. Because the value of crude price has been capped at $60 a barrel, RIL cannot charge a higher price even if oil becomes dearer.

Gas produced by others such as Cairn India and BG too are priced based on their production sharing deals with the government, taking oil price as a factor. (See table) But public sector producers get a price fixed by the government based on the Tariff Commission’s advice. Since production sharing deals are signed at different times, there is a wide variation in the sale price of gas. While the administered prices of gas produced by ONGC and OIL are the cheapest in India , gas from the Panna-Mukta-Tapti field is the costliest.

The government plan means an ultimate integration of natural gas pricing for both public and private sector units, to create a strong investment climate for the sector. This will mean, as FE reported earlier, removing the administered price mechanism of natural gas, because of which there are different prices for public sector and private sector companies at present.

Oil and gas expert and KPMG executive director Arvind Mahajan said the move to delink gas price from the crude price makes sense as gas price is less volatile compared to that of crude. “That is because, on a day-today basis, gas is not as tradable as crude because of transportation issues. Besides, gas from a new source — shale gas — is also available,” Mahajan said.

Globally, the natural gas market is increasingly being seen distinct from that of crude oil because gas is more widely available from diverse and more widespread reserves. Also, North America’s success story of commercially producing shale gas and similar plans by China herald an era of abundance in the case of gas, unlike that of oil, experts said.

Mahajan said that the government should clarify how it would interpret the apex court order with respect to the state’s final say on gas pricing for the benefit of investors....

Source: Financial Express

__________________________________________________________________________________

1 comment:

Oil snapped five days of losses before a U.S. Energy Department report tomorrow that’s forecast to show refinery operating rates increased and gasoline inventories dropped as summer driving season approaches.

Post a Comment