Company Overview:

LyondellBasell is one of the world’s largest polymers, petrochemicals and fuels companies. It is a global leader in polyolefins technology, production and marketing and pioneer in propylene oxide and derivatives. The company is a significant producer of fuels and refined products including biofuels. Headquartered in the Netherlands, LyondellBasell has combined annual sales of nearly $51bn with more than 15,000 employees worldwide.

History:

Lyondell:

Lyondell Chemical Company was the third largest independent chemical manufacturer in the US before it was acquired by the Basell in 2007. Lyondell was formed in 1985 from the integration of selected chemical and refining assets of the Atlantic Richfield Company (ARCO). In 1989, Lyondell was spun-off into a separate company and was listed on the New York Stock Exchange. In 1998, Lyondell gained a leading position in polymers and expanded geographically through the acquisition and integration of Arco Chemical.

In November 2004, Lyondell acquired Millennium Chemicals Inc. in a stock-for-stock business combination. The merger of Lyondell and Millennium Chemicals became official on December 1, 2004. Following the December 1, 2004 transaction, both Millennium and Equistar were wholly owned subsidiaries of Lyondell. In the new organization, Lyondell, Equistar and Millennium remained as a separate legal entity and kept its own separate debt structures.

In August, 2006, Lyondell acquired Citgo's interest in the Lyondell-Citgo Refinery for $2.1 billion, and renamed the facility Houston Refining.

Basell:

On the other hand, Basell was formed in September 2000 when BASF and Shell Chemicals combined their respective polypropylene businesses with their then-existing polyethylene joint venture. Access Industries, a privately held, U.S. based industrial group, subsequently acquired Basell in August 2005.

On December 20, 2007, an indirect wholly owned subsidiary of Basell merged with and into Lyondell, with Basell indirectly acquiring all of the outstanding shares of Lyondell’s common stock at $48.00 per share. The total purchase price, including assumed and refinanced debt, was $20.9 billion. Basell was renamed LyondellBasell Industries AF S.C.A. As a result, Lyondell is now an indirect wholly owned subsidiary of LyondellBasell Industries.

On February, 2008, LyondellBasell Industries acquired Solvay Engineered Polymers, Inc. (“SEP”), a leading supplier of polypropylene compounds in North America. On April 1, 2008, LyondellBasell Industries acquired a refinery at Berre l’Etang and related businesses in France from Société des Pétroles Shell.

LyondellBassell: Business Segments

LyondellBasell operates into four business segments, Fuels, Chemicals, Polymers and Technology and Research & Development

Fuels:

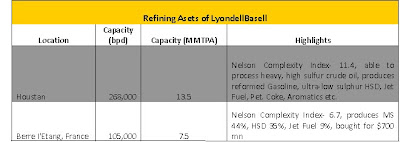

LyondellBasell owns two refineries, one at Houston Ship Channel in Houston, Texas while the other at Berre I’Etang in France. The Houstan-based refinery is capable of processing 268,000 barrels per day (bpd) of heavy crude with high sulfur contents (16-18 degree API) with Nelson Complexity Index of 11.4. The Refinery’s clean products include gasoline (including blendstocks for oxygenate blending), jet fuel and ultra-low sulfur diesel. The Refinery’s products also include heating oil, lube oils (industrial lubricants, white oils and process oils), carbon black oil, refinery-grade propylene, petrochemical feedstocks, sulfur, residual fuel, petroleum coke and aromatics.

The second refinery based at France was bought by LyondellBasell for $700 mn Shell on April 1, 2008. The refinery can process 105,000 barrels of crude every day which scores 6.7 on Nelson Complexity Index.

Chemicals and Polymers:

LyondellBasell is one of the largest producers of chemicals and polymers in the world with the company ranking in the top in olefins and polymer productions. The Rotterdam-based company is the leading producers of polypropylene and propylene oxide in the world and is ranked among the largest in ethylene production.

Technology and R&D:

LyondellBasell is a leading licensor of polyethylene, polypropylene and polyolefin process technology and catalysts. Approximately 40% of the world’s installed polypropylene capacity and 11% of the world’s installed polyethylene capacity used LyondellBasell Industries’ licensed process technologies. Besides, LyondellBasell Industries is the world’s largest manufacturer and supplier of polypropylene catalysts, with approximately one-third of global polypropylene catalyst production.

Global Presence:

LyondellBasell has a global footprint with manufacturing facilities spreading across the world. Manufacturing units of LyondellBasell are present in North & South America, various countries of Europe, Africa and Asia and in Australia.

What does acquisition of LyondellBasell mean for RIL?

Ethylene Manufacturing- : will become 3rd largest producer

LoyondellBasell is presently the fourth largest ethylene manufacturer in the world. With the acquisition of LyondellBasell, the combined capacity of RIL and LyondellBasell will be ranked third among global ethylene producers, marginally behind the second ranked Sabic.

Polyolefin production: total capacity will be 15 MMTPA

LyondellBasell is currently the largest manufacturer of polymers/polyolefins in the world with installed capacity of approximately 11 MMTPA, whereas RIL is placed at 11th spot with manufacturing capacity of about 3.75 MMTPA. Acquisition of LyondellBasell will make the RIL world’s largest manufacturer of polyolefin/polymers with total capacity of nearly 15 MMTPA, far ahead of its competitors.

All Chemicals and Polymers:

RIL has significant presence in polyolefin production. Besides this, company does not have considerable presence in olefins and chemicals segment. Acquisition of LyondellBasell will provide the company leverage to a range of products in both these product lines. Table below provides the details of various product lines and products wherein RIL will score highly on global scale after the acquisition of LyondellBasell-

Fuels:

At present, RIL is ranked at 13th position among the world’s largest refining companies with total processing capacity of 1.24 million barrels per day 9mbpd (mbpd). Acquisition of LyondellBasell, which has two refineries with aggregate refining capacity of 0.37 mbpd, will place the RIL at 12th spot among largest refining company globally with combined capacity of 1.61 mbpd, just marginally behind the National Iranian Oil Company with total refining capacity of 1.66 mbpd. With the acquisition of LyondellBasell, RIL will own about 2% of the total refining capacity in the world.

RIL to bring synergy to LyondellBasell’s operations:

RIL is likely to bring synergy to different business segments of LyondellBasell with its expertise and experience and will also provide new venues and markets to LyondellBassell’s products.

Fuel Segment:

RIL owns and operates world’s largest refining complex in the world with combined processing capacity of the two units at 1.24 mbpd. Nelson Complexity Index of one of the unit is 14 and the other is 11.7. Highly complex refineries allow the RIL to process one of the heaviest crude available in the world, which are available at cheapest rates. Despite processing high-sulfur crude, RIL produces ultra-clean fuels, which are high in demand in environmentally concerned world and can qualify the most stringent norms in any market. Processing of heavy crude has helped RIL consistently outperform the global benchmarks for refinery margin. RIL is supply majority of its products in U.S., European and Middle East markets.

With its expertise in commissioning complex refineries, RIL can upgrade the LyondellBasell’s France Refinery. LyondellBasell’s Houstan-based refinery has higher complexity index and it processes heavy crude and produces clean fuel. This is in-sync with RIL’s refining business plan. Acquisition of LyondellBasell’s refinery by RIL will provide these refineries greater access to various markets world over. RIL has extensive petro-retail network in India and has also acquired Gulf Africa Petroleum Corporation, which has distribution network in several East African countries. This provides opportunity for the LyondellBasell’s two refineries to directly supply their products. If acquire, RIL can direct the output of the Franc-based refinery to African and Indian market, which do not have so-high environmental norms compared to western countries.

LyondellBasell sources majority of its crude requirement from PDVSA Oil on market price. Heavy-reliance on one source poses deep threat of crude supply to the company as the PDVSA on several occasions has declared itself in force majure situation resulting in reduced availability or supply cut. Integration with RIL will allow LyondellBasell’s two refineries to diversify its risk. At the same time, RIL can negotiate for better price of crude, subsequently reducing the cost of raw material and enabling the company (and the two refineries) to better its margins.

Apart from selling products from its own refineries, LyondellBasell also sells refined products purchased from other parties to meet the customer’s requirements. With the acquisition, RIL can supply the required quantity of products to LyondellBasell’s customers from its refineries. Moreover, RIL will have way in to many of LyondellBasell’s customers for its refinery products.

Other refinery products like MTBE, ETBE and alkylate are gasoline blending components, which are produced at various facilities of LyondellBasell in US and Europe and sold in the respective markets. However, in recent times all the refiners and blenders have discontinued the use of MTBE in the US primarily due to US Government’s decision to encourage the use of bio-ethanol in gasoline and guidelines to ban the use of MTBE. This has resulted in consumption issue for LyondellBasell’s MTBE output. Acquisition by RIL will open the door to Indian and other growing markets where use of MTBE is very much prevalent.

Chemicals & Polymers:

LyondellBasell is currently the fourth largest manufacturer of ethylene in the world. Acquisition of LyondellBasell by RIL will make the combined entity the third largest producer of the ethylene globally. Natural gas and naphtha are two major feedstocks for ethylene manufacturing. LyondellBasell uses natural gas or NGL (natural gas liquid) primarily at US facilities and naphtha majorly at Europe facilities for ethylene production. RIL, being an integrated oil & gas company has access to US natural gas producers and thus, can help LyondellBasell’s US-based facilities source the natural gas or NGL at cheaper rates subsequently resulting in lower cost of production and increased margin. Similarly, RIL, which produces naphtha at its refineries at cheaper rates due to use of heavy crude oil, can supply the heavy-liquid to LyondellBasell’s manufacturing facilities based in Europe and other regions at reasonable prices. This will help the combined entity to better its margins.

Ethylene is used as the raw material for producing polymers. LyondellBasell’s ethylene production is majorly consumed at its polymer manufacturing units. Yet, substantial quantity of ethylene is supplied to customers through pipelines. As the acquisition of LyondellBasell by RIL will make the combined entity world’s largest polymer producer, the ethylene produced from LyondelBasell’s facilities could be entirely consumed at LyondelBasell and RIL’s polymer production plants. The ethylene which is sold to customers can be directed to RIL’s petrochemical plants in India.

Demand for other by-products of ethylene has shrunk in recent years, particularly in western markets. RIL’s acquisition will provide the opportunity for LyondellBasell ethylene by-products access to growing markets like India, where demand is rising, despite the economic downturn globally, at reasonably good pace.

As the acquisition will of LyondellBasell will make the combine the largest producer of polymers in the world, miles ahead of its competitors, the company can rewrite the rules in polymer business.

By integrating the business (as both the companies have sizable presence in polymer market), the company can also cut down its production cost and increase the margin. Reduced cost of production will give the company an edge over its competitors. The reduced cost will help the combined entity focus on markets where demand for polymers is growing at higher rate and the penetration is low.

Conclusion:

With the above stated facts, it is clearly evident that, if RIL successfully completes the acquisition of LyondellBasell, it will bring plenty of synergy to the latter’s operations. It can rekindle the LyondellBasell’s refining business, whereas can provide a market for its array of chemicals and polymers. Acquisition of LyondellBasell will make the RIL one of the largest players in chemical and polymer business worldwide, whereas in refining business too it will leapfrog various global players. Hence, it could be safely stated that RIL, as a buyer, is the right choice for LyondellBasell which can ably give a face-lift to its operations and financial health that are continually running on a declining path.

__________________________________________________________________________________

2 comments:

Dear Manav

I keep track on all news related to oil and gas and spcialy reliance industries ltd which owns state of the art refinery in Gujrat and also supplier of natural gas from its D6 krishna godavary basin.US COURT has given LB time upto April 15 2010 to restructure itself what do you think will LB be able to manage of its own.Withpresent crude price and its refining margin and gas out put of 60mmcd where does ril stand .I will be pleased to a regular update from you at my email utpal99@ gmail.com

Thanks a lot for your informative blog on oil and gas .

Dear Utpal,

Thanks for your comments. As far as my personal opinion on LB, I strongly feel that the valuation of LB at $14.5-15 bn is higher. RIL has also reportedly refused to increased its present bid of $13.5 bn. The bid of $13.5 bn seems to be fair to me. In fact, the earlier bid of $10-12 bn seemed more appropriate. As far as funding is concerned, RIL has cash worth $4.8 bn whereas the company has treasury stock worth $8 bn. RIL is looking aggressively for LB and hence even sold the treasury stocks worth more than $2 bn. Therefore, the total cash available with the company has reached nearly $7 bn. Managing remaining $6.5 bn does not seem to be an issue for RIL as the Indian conglomerate has low debt-equity ratio of 0.42x.

LB estimated the average EBITDA (excluding restructuring costs) of $1.9bn in 2009, $1.6bn in 2010 and $2.0bn in 2011. The average EBITDA for these three years at US$1.8bn is significantly lower than pro-forma combined EBITDA of $4.8bn of Basel & Lyondell in 2007. Even at these trough levels, the implied valuation multiples of 5.5-7.5x would be attractive. Therefore, in the long run, the deal seems fairly attractive to me.

However, in the short run, RIL may have to face several challenges. Given the size of LB ($50bn revenue in 2008), compared with RIL ($29bn), acquiring the company may be a very challenging task. Most of LB’s assets are in petrochemicals (the business is likely to endure difficult times in the near to medium term) and moreover most of plants are in high-cost regions. Also, RIL is involved in legal battle with RNRL over the gas row. Hence, cumulatively the issues can create bit of problem in the shorter period. But, overall I am fairly positive about RIL's LB acquisition.

As far the updates are concerned, you can subscribe to our blog to get access to regular updates.

Best Regards

Post a Comment