In a bid to woo fresh investments into the urea sector, the government is considering the option of giving natural gas to new urea manufacturingplantsatadiscountedprice for a limited period and ask stateownedgasdistributorGAILIndia toguaranteelong-termavailability of the feedstock to them. The move is part of the proposed new ureainvestmentpolicy .

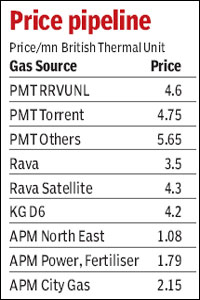

A previous policy , aimed at boosting investments in the sector broughtouttwoyearago,didnotal low new entrants to get gas at the government-administeredpriceof $ 1.79 per million British thermal unit (mmBtu), the lowest price for gas in the country until recently. This had dampened the enthusiasmof investorsintheureasector. "One of the options under consideration is to give subsidised gas for a limited time. If 80% of the cost of urea production is attributable to natural gas price, there should be certainty on the price as well as sufficient supplyof gasfornewinvestments tocomein,"saidagovernment official, who asked not to be named.

The move comes in the wake of governmentraisingtheadministered price to the level at which RILsellsitsK-GD6gas--$4.2. Also, Anil Ambani-promoted RNRL's efforts to get gas from the prolific K-G D6 field at a cheaper rate than the government-fixed price was blocked byaSupremeCourtorderthat said pricing and allocation of gas has to be as per government policy . But the view among some officials is that since the urea sector badly needsinvestments,itcouldget adifferentialpricefora"limitedperiod."

Another government official, who too did not wish to be identified, told FE that at the currentglobalpriceof urea,the feedstock price of $4.2 per mmBtu is viable, but that may notbethecaseif gaspricegoes up. In a gas-based urea plant, there would be a fixed cost of $150 and a variable cost of 21 times the cost of gas for makingatonneof thefertilizer." At the current (administered and KGD6) gas price of $4.2mmBtu, the total production cost works out to $276 a tonne of urea, when the product sells in global markets at $290 a tonne. That makes the $4.2aviablefeedstockpricefor urea. But if it goes up, the plant’s viability will be affected,”explainedtheofficial,emphasising the need for firm commitments on price and supplyof naturalgas.

Manufacturers who have not availed the previous urea investment policy of 2008 get gas at the APM price and gets a 12% post tax return on the commodity,w hich is under pricecontrol.Beneficiariesof the policy were to get a better price for urea but had to rely on non-APM gas. But the policy didnothelpmuchintheabsence of guaranteed availability of affordable gas.

Therehasbeennonewinvestments in the urea sector for more than a decade,making supplies fall short of demand by an estimated 1.9 crore tonne by the end of next year.

Now, under the proposed new policy, the government is alsolookingatprovidingsome incentives for building gas pipelines to new urea production facilities as gas is more efficient a feedstock than naphtha,saidtheofficial.

“There is no point in askingproducerstoshifttogasin, say three years,ift here are no pipelines,” the official said.

Source: Financial Express

__________________________________________________________________________________